Buying a home is a proud milestone, but it also comes with a new responsibility: making sure your family and your home are financially secure if something unexpected happens.

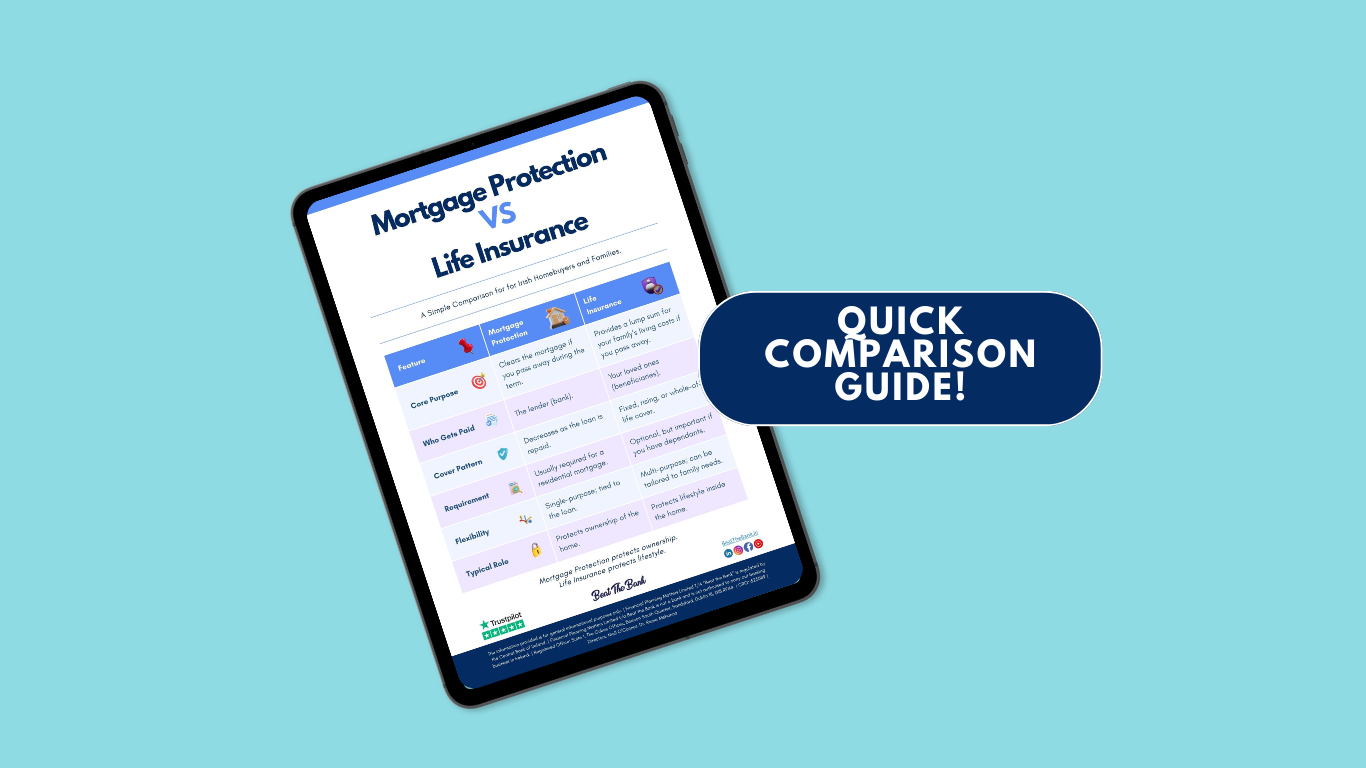

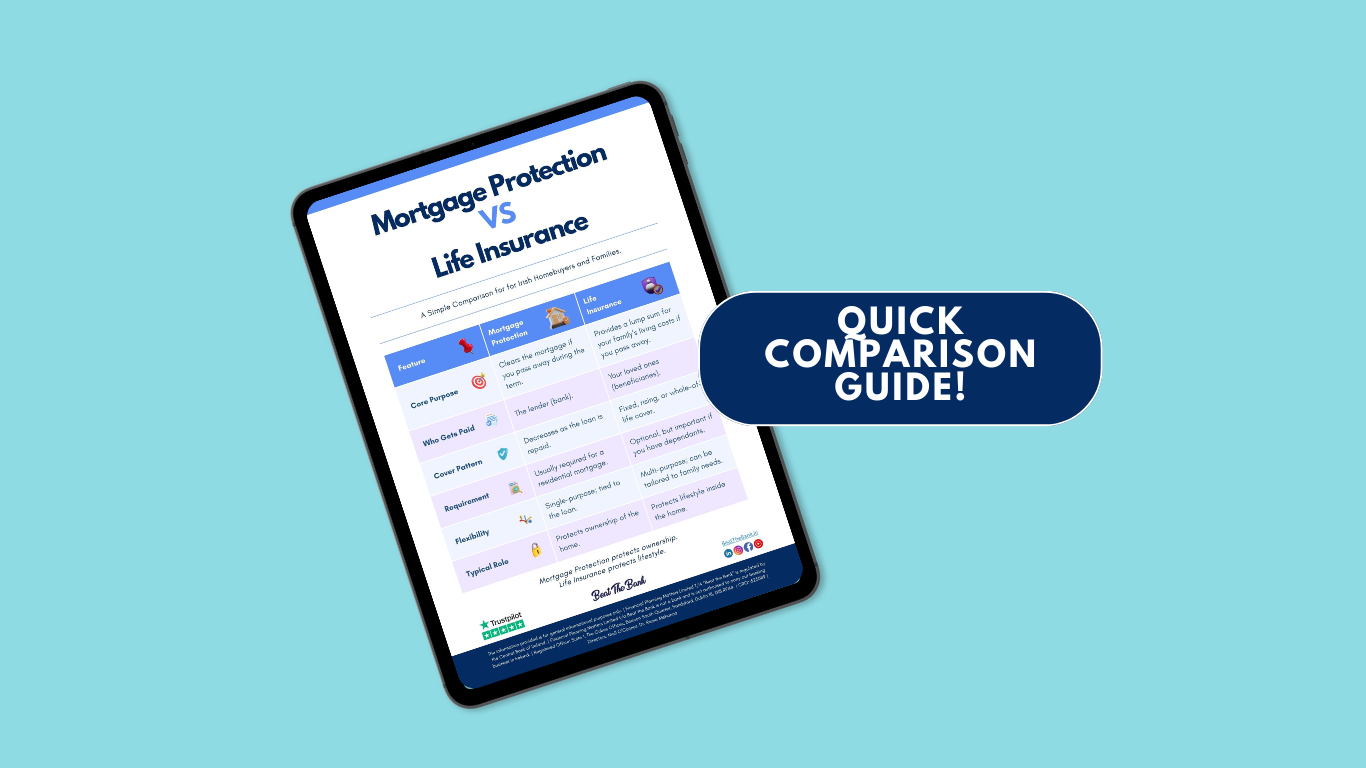

That’s where Mortgage Protection and Life Insurance come in. They can sound similar, but both types of cover are important (and so is understanding the differences!)

🔹Mortgage Protection clears the outstanding balance on your mortgage if you pass away during the term of the loan. In short, it protects the house.

🔹Life Insurance pays a lump sum to your family. That money can be used for bills, childcare, education, or day-to-day living costs. It protects the household.

👉 We’ve created a simple 1-page comparison , so you can see the differences at a glance.

Protecting the roof over your head is one thing – protecting the people under it is another. Many families find they need a mix of both.

➡ Click here to open Mortgage Protection vs Life Insurance (PDF)

📖 Read more helpful information on our Learn page

📱 Follow us on Instagram, LinkedIn and Youtube for more useful tips