When Should I Apply for Income Protection?

When Should I Apply for Income Protection? Income protection insurance is designed to replace part of your income if you can’t work due to illness or injury. But one common question people ask is — when is the right time to apply? The short answer: the earlier, the better. Why Timing Matters Just like life

What Is Income Protection?

What Is Income Protection? Income protection is an insurance policy that replaces a portion of your income if you cannot work due to illness or injury. It is designed to provide a regular monthly payment so you can continue to cover essential bills while you recover. How Income Protection Works Income protection provides a monthly

When Should I Apply for Life Insurance?

When Should I Apply for Life Insurance? Many people delay buying life insurance, thinking they’ll do it later — but the truth is, the earlier you apply, the better. Getting life insurance while you’re young and healthy helps you lock in lower premiums and ensures your loved ones are protected from the start. The Best

What is Life Insurance?

What Is Life Insurance? Life insurance is a simple way to protect the people you love. If you die during the term of the policy, it pays out a tax-free lump sum to your family. That money can be used for anything they need; like paying the mortgage, covering bills, or keeping life on track

Who Is The Beat The Bank?

Who Is Beat The Bank? At Beat The Bank, our mission is to make insurance simple, fast and fair. We believe that when it comes to protection; whether it’s mortgage cover, life insurance or income protection; you shouldn’t be stuck with banks’ mark-ups, mountains of paperwork or endless waiting. Co-founded by Niall O’Connor MSc CFP®

The Busy Man’s Guide to Faster Healthcare

Because nobody has time to be sick Between work, family, and everything else, most of us don’t make time for healthcare until we have to. But getting checked, seen or sorted shouldn’t mean taking a day off or waiting weeks for an appointment. That’s where our new Health Insurance comes in. We’ve partnered with Irish

The Women’s Health Benefits No Other Insurer Offers

Finally – health cover that puts women first For too long, women’s health has been treated as an afterthought in insurance. Getting answers has often meant long waits, uncomfortable conversations, or simply not being taken seriously. That’s changing. Our new Health Insurance, in partnership with Irish Life Health, is designed with real women in mind.

Budget 2026 Ireland: Small Gains, Real Choices

Budget 2026: The Headlines That Matter Budget 2026 Ireland delivered some small gains for households – but not much that will change the day-to-day reality of Irish finances. At Beat the Bank, we believe the real difference comes from what you do next: comparing your options, cutting costs where you can, and keeping more money

Health Insurance is HERE (with benefits you’ll actually use)

The wait is over. You asked for it – and it’s here. You’ve trusted us to help you save on life cover, mortgage protection and income protection. Now, for the first time, Beat The Bank has launched Health Insurance – giving you access to great-value cover with benefits you’ll actually use through our new partnership

Meet Zoe: Beat the Bank’s AI Assistant

At Beat the Bank, our mission has always been simple: make protection clearer, faster, and better value for Irish households. Now, we’re taking that commitment one step further with the launch of Zoe, our new AI-powered assistant. Zoe isn’t just another chatbot. She’s designed to answer your insurance questions instantly, explain complex terms in plain

5 Surprising Benefits of Switching to Our Health Insurance

Still on the same health plan you’ve had for years? You’re not alone – switching health insurance can feel like a hassle. But staying put often means missing out on real, practical benefits that could make your life easier (and healthier). Our Health Insurance, in partnership with Irish Life Health, includes benefits you won’t find

Weight Loss Injections and Mortgage Protection in Ireland

Weight loss injections have become a major talking point in Ireland and abroad, with high-profile figures like Serena Williams adding to the conversation. But if you’re applying for mortgage protection in Ireland and you’re currently using weight loss injections, it’s important to understand how insurers approach this. We asked Sharon Doyle, Director of Operations at

6% Interest Rate: What It Means for Your Cover

What is Mortgage Protection? When you get a mortgage to buy your home, you will need to take out mortgage protection insurance. This is a particular type of life assurance that is taken out for the term of the mortgage. It pays off the mortgage if you, or someone you have the mortgage with, dies.

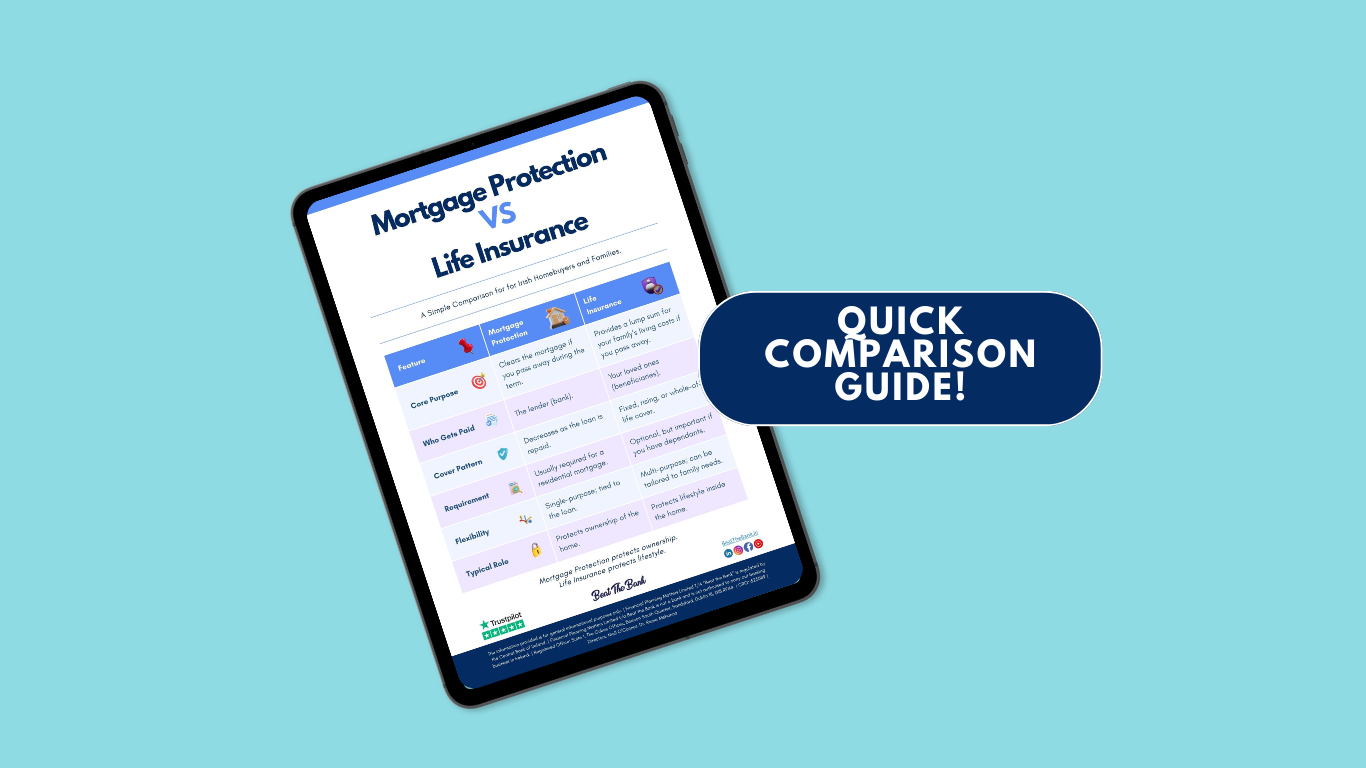

Mortgage Protection and Life Insurance: What’s the Difference?

Buying a home is a proud milestone, but it also comes with a new responsibility: making sure your family and your home are financially secure if something unexpected happens. That’s where Mortgage Protection and Life Insurance come in. They can sound similar, but both types of cover are important (and so is understanding the differences!)

Growing Skills, Building Confidence: BeatTheBank.ie & Financial Planning Matters x Coerver Coaching

At both BeatTheBank.ie and Financial Planning Matters, we’re all about helping families make smart, simple decisions that protect their future. That’s why this summer, we were proud to team up with @coervercoachingleinster to support a brilliant 5-week grassroots football programme at Divine Word National School in Marley Grange. Designed to help young players build confidence,

Self-Employed in Ireland? PRSI Contributions Explained

Being self-employed in Ireland gives you independence and flexibility – but it also means you don’t have the same safety net as PAYE workers. One of the biggest gaps is around social welfare supports, and it all comes down to the type of PRSI contributions you pay. PRSI for the Self-Employed in Ireland: What’s Covered

How Snus, Vaping or Even One Cigarette Could Affect Your Insurance Cover

When it comes to smoking and vaping life insurance in Ireland, most people think it’s all about cigarettes. But insurers take a much stricter view. If you’ve used any nicotine in the last 12 months – whether from vaping, snus, nicotine pouches, or even gum – you’re classed as a smoker. And yes, that smoker

Switching Lenders? Check Your Mortgage Protection

With mortgage interest rates coming down, more homeowners in Ireland are looking at ways to secure a better mortgage deal. Whether that means changing lender, shortening your term, or restructuring your loan, there’s one detail that’s easy to overlook- switching mortgage protection as well. We asked Sharon Doyle, Director of Operations at Beat The Bank, to

What Would Happen If You Couldn’t Work Tomorrow? You Need To Protect Your Income.

We insure our homes, cars and phones without thinking twice, but we rarely protect the income that makes everything else possible. Many people in Ireland assume they’ll always be able to work, yet illness or injury can interrupt your earnings for months or even years. Income protection is an insurance policy that steps in if

Not Sure What Protection You Need? Try Our Free Risk Calculator

Wondering if you need life cover, income protection, or serious illness insurance? You’re not alone – figuring out what kind of financial protection you actually need can feel overwhelming. But we’ve made it easier than ever with our free Risk Calculator. This simple online tool only takes a couple of minutes, and gives you a

What Is a Life of Another Insurance Policy – And Why It Might Save You Thousands

When it comes to life insurance, many people in Ireland don’t realise that you can take out a policy on someone else’s life — and that it could be a powerful tool in protecting your finances. This is called a “Life of Another” policy, and it’s especially useful for unmarried couples, business partners, or anyone

Are You a Smoker Without Realising It? What Insurers Really Count as Smoking in Ireland

When it comes to life insurance in Ireland, many people are surprised to learn that being labelled a “smoker” isn’t just about lighting up cigarettes. Even if you only vape occasionally, use nicotine gum, or haven’t touched a cigarette in months, insurers may still classify you as a smoker — and that can significantly increase

Switching Your Mortgage? Don’t Forget Your Mortgage Protection.

If you’re one of the thousands of Irish homeowners considering switching your mortgage, you’re not alone – and you might be making a very smart move. According to the Banking & Payments Federation of Ireland (BPFI), nearly 4 in 10 new mortgage approvals are from switchers – not first-time buyers. That’s a clear sign that

When Should I Apply for Mortgage Protection?

When Should I Apply for Mortgage Protection? If you’re buying a home in Ireland, Mortgage Protection is one of the key steps you’ll need to take before drawing down your mortgage — but many buyers aren’t sure when exactly to apply. Too early and things can expire. Too late and you might hold up your

Vaping, Nicotine & Life Insurance: What Irish Insurers Really Count as Smoking

If you’re applying for mortgage protection, life insurance or income protection in Ireland and you vape – or only smoke socially — you might be thinking: “Sure I’m not technically a smoker, right?” You’re not alone, we hear this all the time at Beat The Bank. Many people are surprised to learn that even the

€57 Million in Claims: What Royal London’s 2024 Stats Tell Us About the Importance of Protection

Let’s face it — nobody wants to think about life insurance or income protection. But the numbers from Royal London’s latest claims report show exactly why more people should. In 2024, Royal London Ireland paid out over €57 million in protection claims — helping real people through life’s hardest moments. And here’s the key stat:

Income Protection: What It Is, Why You Might Already Have It, and What to Do Next

When we think about insurance, most of us go straight to mortgage protection — and no surprise, it’s by far the most common policy we help people with here at Beat The Bank. But what if your income stopped tomorrow? How would you cover the mortgage, the car loan, the bills? That’s where income protection comes

Life of Another: A Smart Protection Strategy for Couples, Business Partners & Families

💡 What is a Life of Another policy? It’s a life insurance policy taken out by one person on the life of another — often used when there’s a financial connection, such as a shared mortgage, business partnership, or inheritance planning need. 🟢 When is it relevant? 🏡 Cohabiting couples – To help cover potential

Income Protection: The Most Important Insurance You’ll Ever Buy

Forget mortgages. Forget pensions. Forget savings. Forget health insurance. Before you spend a cent on anything else, you need income protection. It’s the single most important financial product you’ll ever take out – because if you can’t work, you can’t pay for anything else. What Happens If Your Pay Cheque Disappears? Your income is the

Why Every Irish Parent Needs Life Insurance: Securing Your Family’s Future

Introduction As a financial advisor, one of the most frequent questions I encounter from Irish parents is whether life insurance is truly necessary. Many believe that life insurance is either too costly or simply not needed. In this blog, I aim to dispel these misconceptions and highlight the critical role life insurance plays in securing

Navigating Mortgage Protection with Beat the Bank

Owning a home is not just about having a space to call your own; it’s about securing your family’s future. Amid the joys of homeownership, it’s essential to address the potential financial uncertainties that may arise. Mortgage protection is your safeguard, and with Beat the Bank, it’s a journey towards digital ease, instant assurance, and

What is a Private Medical Attendant Report

Like many people these days, you have probably found yourself shopping online for insurance at some time or another. While the process varies depending on precisely what sort of coverage you are looking for, in most cases it will include the completion of a simple questionnaire in order to collect basic details about your health

The Benefits of Beat the Bank: Simpler, Cheaper Mortgage Protection

Beat The Bank was founded on the belief that homeowners deserve a better insurance platform to purchase their plan at the cheapest price without having to accept a watered down policy! Many people don’t know they can shop for mortgage protection, but why buy an expensive policy from your lender when you can get a

Do You Need Life Insurance for a Mortgage?

When speaking of mortgages, the type of life insurance that banks and lenders are usually referring to when they are talking about life insurance is ‘Level Term Protection’. This is usually seen as an ad on/extra and not a requirement.

Things You Must Know Before You Get a Mortgage

Before you proceed to buy a house or apartment you must get mortgage approval and preparing yourself for approval can take years.

Smokers With Mortgages pay €3,000 – €20,000 more over the term of their mortgage

If you have a mortgage, although you may not be aware, you are paying mortgage protection insurance.

Mortgage holders can save thousands by moving their mortgage protection away from the bank!

If you have a mortgage, chances are you’re spending hundreds or even thousands of euro a year on life insurance.

What is Mortgage Protection?

Mortgage protection is the most cost effective form of life assurance and is used most widely to protect both the borrower and the bank against the risk of the borrower dying within the term of the mortgage.

Co-Habiting Couples & Mortgage Protection … A tax landmine if not set up correctly

Marriage is not everyone’s cup of tea but certainly, it can be a very tax-effective route to go given the way Revenue look on cohabiting couples.