Vaping, Nicotine & Life Insurance: What Irish Insurers Really Count as Smoking

Niall O'Connor MSc CFP® QFA

Co-Founder

If you’re applying for mortgage protection, life insurance or income protection in Ireland and you vape – or only smoke socially — you might be thinking: “Sure I’m not technically a smoker, right?”

You’re not alone, we hear this all the time at Beat The Bank.

Many people are surprised to learn that even the occasional vape on a night out, or the odd nicotine patch, means you’re classed as a smoker by insurers — and that has a direct impact on the cost of your cover.

So, what exactly counts as a smoker for life insurance in Ireland? Let’s walk through what insurers in Ireland count as smoking, the risks of getting it wrong, and how Royal London’s non-smoker declaration could make things easier if you’ve been nicotine-free for 12 months.

When it comes to life insurance, mortgage protection and income protection in Ireland, most providers use a strict definition. You’re considered a smoker if you’ve used any form of nicotine in the last 12 months. That includes:

🔴 Tobacco products: cigarettes, rolling tobacco, cigars, snus, etc.

🔴 Vapes or e-cigarettes

🔴 Nicotine patches, sprays, or gum (NRT : Nicotine replacement therapy)

We hear this a lot:

“But I only vape – I haven’t smoked a cigarette in years!”

“I just have one now and again when I’m out.”

Unfortunately, insurers don’t look at frequency. If you’ve had any nicotine in the last 12 months — even once — you’re still considered a smoker for life cover purposes.

That applies to all forms of cover:

✔️ Mortgage Protection

✔️ Life Insurance

✔️ Income Protection

It doesn’t matter whether you’re a daily smoker or just someone who vapes at the weekend. One use within the last year? Smoker rates will apply to you.

Smoker premiums are higher because insurers view nicotine users as higher risk. That’s not new — and it’s not something we need to preach about. If you smoke, you already know the risks.

But many people don’t realise that vaping, using NRT, or being a “social smoker” also pushes you into the same premium category.

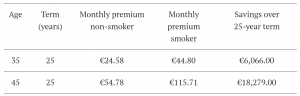

Here is a recent cost analysis conducted by Royal London Ireland to illustrate the difference between premiums paid by non-smokers and smokers for Level Term Assurance Life Cover:

Tempting as it might be to tick the “non-smoker” box and hope for the best — it’s never worth it.

It’s the same with your medical history, be honest, and there won’t be any issue in the event of a claim.

Insurers check. It’s not worth the risk.

Let’s say you were a smoker, but you’ve been completely nicotine-free for 12 months. With most providers, switching to non-smoker rates means starting from scratch — a full re-application, new underwriting, and potentially higher pricing based on your age and health.

Royal London are different.

If you’ve been off all nicotine for 12 months, you can submit a simple non-smoker declaration — no reapplying, no starting over — and they’ll switch you to non-smoker rates.

That’s a unique feature that makes them stand out. And it’s one of the reasons why we work exclusively with Royal London at BeatTheBank.ie.

At Beat The Bank, we quote across the market to compare the main five life insurers in Ireland. Then we take the lowest price, match it, and go further — by using our market-leading discount from Royal London, and sacrificing part of our commission to give you the lowest price available.

We partner exclusively with Royal London because they consistently come out on top — both on price and on policy benefits.

What To Do Next

Have you been off nicotine for 12 months? Congratulations — let’s make sure your cover is reflecting that.

Get in touch today and let’s get you set up with non-smoker rates.

📩Contact us at unbeaten@beatthebank.ie

📍 Compare quotes instantly at beatthebank.ie

📖 Read more helpful information on our Learn page

📱 Follow us on Instagram and LinkedIn for more tips

No contact details required

years

€

OTP send successfully

Please enter your 4 digits OTP

Message send successfully

Please enter a valid email

Thank you for registering your interest. We are working on adding new products to our offering and will reach out to you once these are available.

We use cookies to enhance your browsing experience and analyse our traffic. By clicking “Accept”, you consent to the use of cookies in line with our Cookies Policy.