6% Interest Rate: What It Means for Your Cover

Niall O'Connor MSc CFP® QFA

Co-Founder

When you get a mortgage to buy your home, you will need to take out mortgage protection insurance. This is a particular type of life assurance that is taken out for the term of the mortgage. It pays off the mortgage if you, or someone you have the mortgage with, dies.

When you take out a mortgage protection policy, the insurer must ensure that the cover amount (the benefit that pays off the mortgage if you pass away) keeps pace with your outstanding mortgage balance. Because a mortgage typically reduces over time, the cover decreases as well. However, insurers don’t know exactly what interest rate your lender will charge over the life of the loan.

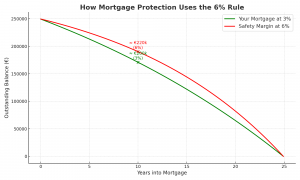

To protect themselves (and make sure the policy will always be enough to clear the mortgage), insurers use a “rate band” – in Ireland this is commonly 6%.

Let’s say your mortgage interest rate is 3%.

The insurer calculates your policy as if the mortgage interest rate were up to 6%.

This means your cover may run a little higher than your actual mortgage balance in early years (a safety margin), but it ensures you won’t be left with a shortfall if rates rise in future.

If your mortgage rate stays below 6%, the policy will always be sufficient.

If rates ever went higher than 6%, there’s a small risk your policy might not fully clear the loan – but this is rare, and lenders/insurers typically review if such conditions arise.

Peace of mind: You know your policy will clear the mortgage in most realistic interest rate scenarios.

Regulation-driven: The 6% standard is set so policies remain fair and comparable across providers.

Cost factor: Because insurers must assume a higher rate, premiums may be slightly higher than if they only calculated on your actual mortgage rate.

✅ In short: The 6% interest rate band is a safety buffer that insurers build into mortgage protection policies to make sure the payout will cover your mortgage even if interest rates rise.

Your mortgage balance goes down over time as you make repayments. But the exact speed at which it reduces depends on your lender’s interest rate. Since interest rates can change, insurers need to allow for this when designing your policy.

To be safe, insurers assume your mortgage could cost you up to 6% interest per year. They then set the cover amount on your policy based on this higher figure.

Imagine you borrow €250,000 over 25 years:

If your mortgage interest rate is 3%, your repayments steadily reduce the loan over time, and your balance might be about €200,000 after 10 years.

If the interest rate were 6%, your repayments would reduce the loan more slowly, and the balance after 10 years might still be around €220,000.

By basing your protection on the 6% figure, the insurer ensures your policy is high enough to cover the bigger balance – giving you and your family a safety margin.

If your actual mortgage rate is lower (say 3% or 4%), your policy will more than cover the balance.

The 6% “buffer” ensures your loved ones won’t be left with a shortfall if interest rates rise in the future.

In the very unlikely event rates ever went above 6%, there could be a small shortfall, but this would be unusual and monitored closely.

The 6% rule is essentially a safety net. It makes sure your family is protected and your mortgage can be cleared, even if borrowing costs go up. It gives you peace of mind knowing that your home is safe no matter what happens with interest rates.

✅ In summary: The 6% interest rate band is not an extra cost or hidden fee – it’s a protection measure that ensures your mortgage protection policy does its job properly.

Your home is your family’s foundation – let’s make sure it’s protected properly.

Reach out to us at unbeaten@beatthebank.ie

📖 Read more helpful information on our Learn page

📱 Follow us on Instagram, LinkedIn and Youtube for more useful tips

No contact details required

years

€

OTP send successfully

Please enter your 4 digits OTP

Message send successfully

Please enter a valid email

Thank you for registering your interest. We are working on adding new products to our offering and will reach out to you once these are available.

We use cookies to enhance your browsing experience and analyse our traffic. By clicking “Accept”, you consent to the use of cookies in line with our Cookies Policy.